Image Credits: Li-Anne Dias

Stories about seed funding often contain juicy metaphors about planting seedlings and nurturing them to maturity. In fact, it's a brutally Darwinian business: most companies fail, successful ones are weakened, and exits usually take a decade or more.

That said, seed also has the highest potential returns of any investment stage. Unlike most VCs, early stage and angel investors can do a lot of deals with a few million dollars. And no one complains that it's boring.

So far this year, the relative failures of early-stage investments seem to outweigh the draws. Fewer North American seed funds were raised in 2017 compared to the previous year's levels, according to an analysis of Crunchbase data. Total investments and round numbers are also steeply down over the past 12 months from the year-ago period for seed and angel offerings, although late-stage investment is on the rise.

So who are the brave souls going out with capital for the first time? Crunchbase News combed through this year's new fund data to reveal more than 30 exciting new funds based in the US and Canada. We've identified some areas that are particularly hot with early-stage entrants, most of whom share the feeling that the window to support early adopters in select areas will only be open for a short time.

Some of the trending seed investment industries should come as no surprise to anyone familiar with the buzz around artificial intelligence and virtual reality. Other trends were less predictable, including an increase in funding for some geographies long considered underserved by venture capitalists and angels.

Here are some trends we noticed.

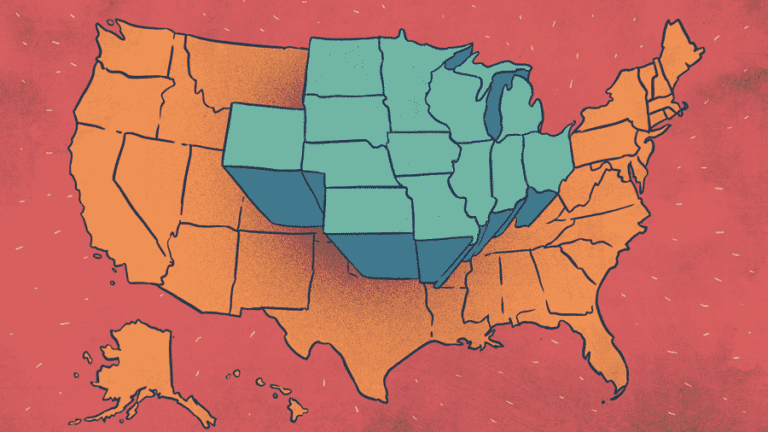

Invest in the Midwest

There's nothing new about venture and angel investors talking up the merits of the Great Lakes region, given the rich tech talent and less-than-rich startup valuations to be found there. However, there is a difference between talk and action. What we're seeing recently are new Midwest-based seed companies raising capital in the region, not just saying good things about the founders there.

So far this year, Crunchbase has identified several Chicago-based seed funds. Purple Arch Ventures supports startups affiliated with Northwestern University alumni. Germin8 Venturesas the name would imply, it invests in agtech. Anonymous Enterprisesmeanwhile, it's looking for accredited investors who want to invest in Chicago-area startups.

It wouldn't be right to classify interest in Chicago as a purely 2017 phenomenon, as it's something that's been percolating in recent years. Crunchbase detailed at least 10 Chicago-based investors that have emerged in the last year or two. Their geographic focus areas vary, with several focusing on the Chicago area, others in the Midwest, and still others looking for deals nationwide.

Some of the trending seed investment industries should come as no surprise to anyone familiar with the buzz around artificial intelligence and virtual reality.

Other Midwest-focused funds established this year include; Grand Venturesa fund based in Grand Rapids, Mich. which invests in Midwestern technology startups and Loop Venturestechnology investor with offices in Minneapolis and New York.

“Being in Minneapolis and working to build our network among other VCs, there's no doubt there's a lot of excitement for the Midwest.” Andrew Murphy, Loup partner, told Crunchbase News. Compared to coastal tech hubs, the Midwest “is underserved, the prices are better and the opportunities are less in volume, but no different or better in quality.”

Big appetite for hard technology

Start cheap and build fast has long been a popular mantra for startups and their investors. Lately, however, there seems to be a pendulum swing toward more investment in so-called hard technology, targeting companies working on complex technical problems with long development time horizons.

Probably the poster child for this approach is MIT The machine, which closed a $200 million debut fund in September. The fund's stated mission is to help founders develop, commercialize and scale scientific discoveries in “hard technologies,” with a focus on Boston-area startups. So far it supports startups working on satellite communications, a digital approach to odor detection, and technology to more efficiently transport drugs into the gastrointestinal tract.

Hard tech isn't exactly something that seeds and angels have shied away from in the past. Life sciences startups, which are known for their long growth cycles, traditionally earn a large share of early-stage dollars. Hardware, medical devices, space technology and other areas known for long exit timelines were also popular with the angel crowd.

However, a rising profile for hard tech may suggest that investor interest is waning for fast-to-market, consumer-facing startups that have proliferated amid the rise of the app economy.

It's a brutally Darwinian business: most companies fail, successful ones are weakened, and the exit usually takes a decade or more.

This perspective is echoed by Jason Cahillmanaging director at McCune Capital Managementa New York-based early-stage tech investor that launched this year

“I feel like we're approaching a saturation point when it comes to startups with mass consumer appeal, like social sharing apps, ride sharing, as well as fintech and adtech,” Cahill told Crunchbase News. “But in industries like transportation, clean tech, waste collection and even publishing, I'm extremely excited by what I'm seeing and the amount of opportunity.”

The Engine and McCune are two of several investors who have raised capital for the first time in the past year. We put one together list of many here.

Artificial intelligence is under-advertised

Early stage investors don't seem to think AI is overkill. Many new startup funds list artificial intelligence as a key area of focus. we counted at least half a dozen of North America this year. There are probably more.

“There's definitely a timing element,” Loup's Murphy says of AI investments. For the Loup partners, the decision to start a seed fund now came largely from the founders following Apple and other large-cap tech companies in their previous gig as analysts at Piper Jaffray. Big tech companies have invested heavily in artificial intelligence (as well as robotics and virtual reality), and it's reasonable to expect that they'll continue to do so. This is a sign of confidence in the sector and also means that there are many buyers with deep pockets.

But while investors are excited about AI's potential, they're also skeptical of many of the self-described AI startups seeking funding.

The founders, after all, have realized that AI is an area that attracts more funding, he says Eric Bunnfounding partner in Hustle Fund, a startup investor launched this year to focus on fast-moving very early-stage startups. This has led to many companies “trying to fill in some kind of AI story when they're not really an AI company.”

Fertile ground?

It remains to be seen, of course, whether the currently burgeoning crop of Midwestern hard-tech, AI-enabled startups will bear fruit for investors. As noted earlier, most seedlings do not make it. However, those that do could bring some game-changing technologies to the fore, not just another app to make your shopping more convenient.